Panorama – November 2025

Panorama November 2025 edition is out now!

Panorama is a meticulously crafted report that provides a comprehensive overview of the macroeconomic factors and market trends influencing India’s economic landscape.

Here are the key insights from the report:

- Increase in economic uncertainty and heightened geopolitical risk are likely to strengthen safe-haven demand for gold. Meanwhile, high US fiscal deficit and rising debt are eroding the US dollar’s safe-haven appeal.

- Gold prices and real yields generally exhibit an inverse correlation. Factors such as elevated inflation, impending rate cuts, and the end of the Fed’s balance sheet reduction could all push real yields lower. The decline in real yields can stimulate investment demand and further boost gold prices.

- Central banks are buying gold to diversify their foreign exchange reserves away from the US dollar. The freeze on Russia’s FX reserves has reinforced their preference for gold as an asset less exposed to sanctions risk. As of June 2025, the USD accounts for 44% of central bank reserves (down from 62% in 2000), followed by gold at 22% and the euro at 17%. Excluding the G7 countries, gold accounts for 14% of total central bank reserves.

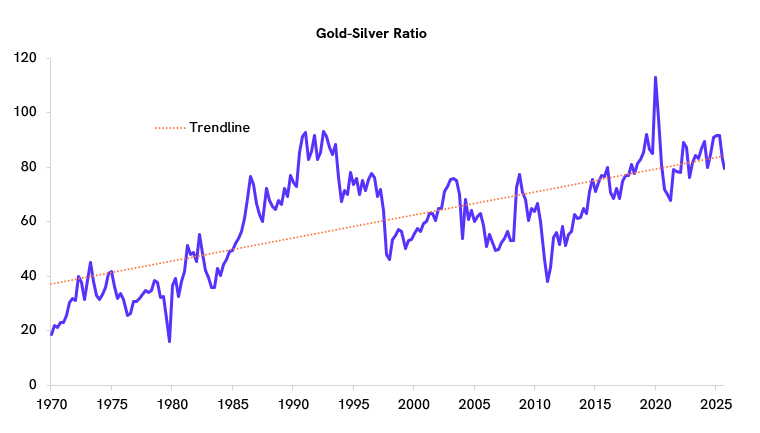

- Industrial use in electrical equipment, electronics, photovoltaics, photography, alloys and other applications accounts for about 61% of total silver demand. Silver’s industrial use makes it more exposed to economic cycles than gold. Macro factors like central bank buying, safe-haven demand, and USD debasement risks favour gold over silver

- Gold offers superior diversification benefits, owing to its lower correlation with equities compared with silver. It also demonstrates much lower volatility, broadly in line with the Nifty 50, while silver’s volatility is almost twice as high.