We are pleased to present a comprehensive analysis of the Union Budget 2026–27. This report provides detailed insights into the central government’s projected finances, evaluates the credibility of revenue assumptions, and offers an in-depth review of expenditure plans. It also…

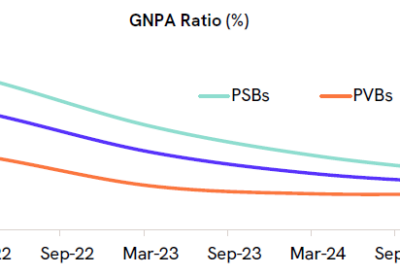

Panorama January 2026 edition is out now! Panorama is a meticulously crafted report that provides a comprehensive overview of the macroeconomic factors and market trends influencing India’s economic landscape. Here are the key insights from the report: Banking sector asset…

We are pleased to present the 360 ONE Asset Outlook 2026, offering an in-depth exploration of the key factors shaping the economy and financial markets in the year ahead. This report provides a detailed analysis of the structural and cyclical…

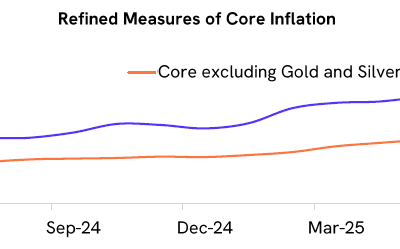

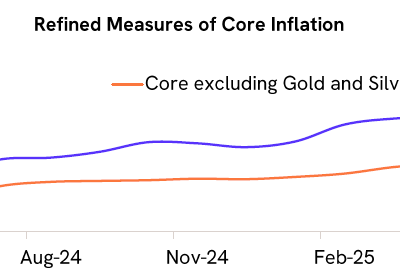

India’s retail inflation rose to 1.33% YoY in December 2025 from 0.71% YoY in the previous month. The uptick was primarily driven by a lower disinflationary impact from food prices. Food inflation increased to -1.8% YoY in December 2025 from…

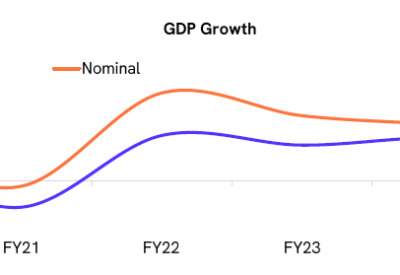

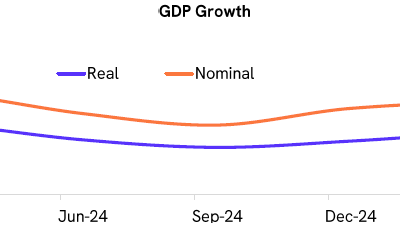

The first advance estimates peg India’s FY26 real GDP growth at 7.4% YoY, up from 6.5% YoY in FY25. The improvement is led by the manufacturing sector, which recorded 7% YoY growth, up from 4.5% YoY in FY25. The services…

Panorama December 2025 edition is out now! Panorama is a meticulously crafted report that provides a comprehensive overview of the macroeconomic factors and market trends influencing India’s economic landscape. Here are the key insights from the report: We believe the…

India’s retail inflation rose to 0.71% YoY in November 2025 from a series low of 0.25% YoY in the previous month. Higher food prices primarily drove the uptick in inflation. Food inflation increased to -2.8% YoY in November 2025 from…

We are excited to introduce the latest report in our Spotlight series: India in a Fractured World. The report examines the evolution of globalisation, the factors contributing to its current retreat, and the emerging fault lines that have intensified resistance…

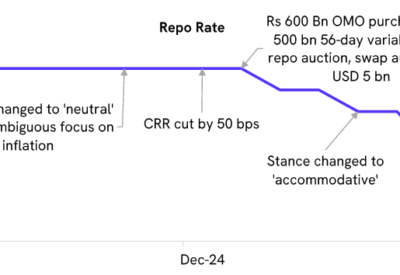

The RBI’s Monetary Policy Committee (MPC) votes unanimously to reduce the policy repo rate by 25 bps to 5.25% in the December 2025 meeting. The policy stance remains unchanged at ‘neutral’. The RBI also announces liquidity infusion of Rs 1.45…

India Q2FY26 Gross Domestic Product (GDP) growth accelerated to 8.2% YoY from 7.8% YoY in the previous quarter, significantly exceeding the RBI’s projection of 7.0% YoY. Gross Value Added (GVA) picked up to 8.1% YoY in Q2 from 7.6% in…