We are pleased to introduce the 360 ONE Asset Macro Outlook for 2024. This outlook explores the key themes expected to shape the macroeconomic landscape in 2024. We discuss various facets of the Indian economy, offering our perspectives on economic…

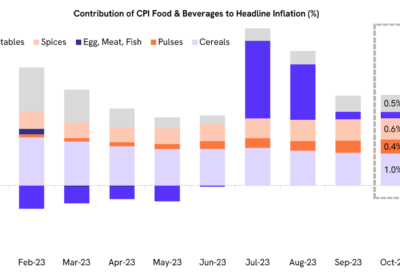

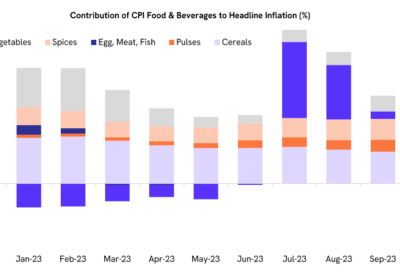

In December 2023, India’s Consumer Price Index (CPI) inflation rose to 5.69% YoY from 5.55% YoY in November on account of higher food inflation. Food inflation rose to 8.7% YoY in Dec’23, from 8.0% YoY in the previous month. Food…

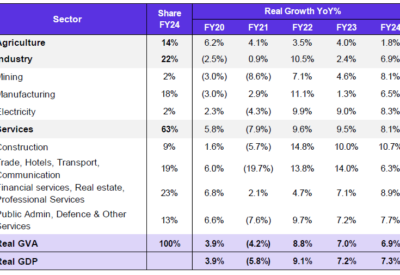

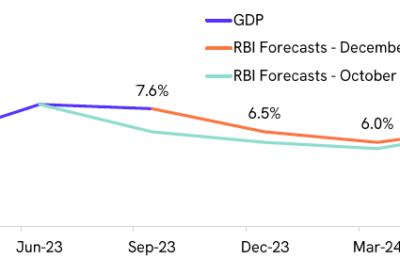

The first advance estimates peg India’s FY24 GDP growth at a robust 7.3% YoY. Financial services+ posts a healthy growth of 8.9% YoY, driven by strong credit and deposit growth. The manufacturing sector rebounds to 6.5% YoY on account of…

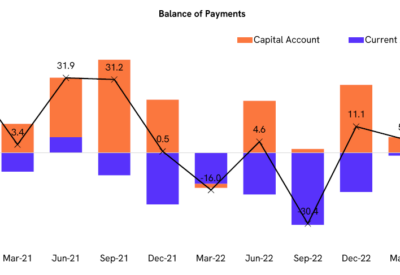

In Q2FY24, India’s Current Account Deficit (CAD) marginally narrowed to 1.0% of GDP in Q2FY24 from 1.1% in the previous quarter. The current account was broadly stable as an improvement in services exports offset the higher merchandise trade deficit. Higher…

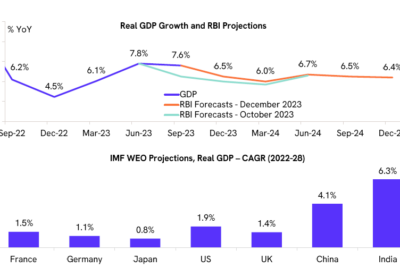

Panorama December 2023 edition is out now! Panorama is a meticulously crafted report that offers a comprehensive view of the macro factors and market trends shaping India’s economic landscape. Here are the key insights from the report: India’s GDP growth…

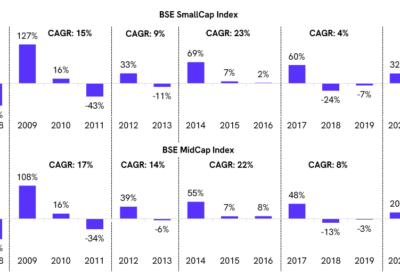

Small-caps and mid-caps have experienced a substantial rally compared to large-caps. However, the surges in the small-cap and mid-cap segments have resulted in frothy valuations, as indicated by a price-to-book ratio significantly higher than the long-term average. In contrast, large-caps…

Indians take weddings seriously. That’s it, I could end this right here, with no further explanation and no one would have difficulty in believing me – There would be few who haven’t witnessed this grandeur. Even the most modest affairs…

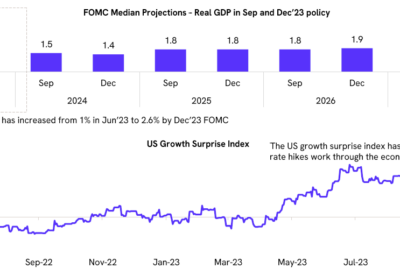

The US FOMC maintained the Federal Funds Rate within the target range of 5.25-5.50% during the December 2023 meeting and indicated three 25 bps rate cuts in 2024. US economic growth continues to remain strong, as indicated by the upward…

In November 2023, India’s Consumer Price Index (CPI) inflation rose to 5.55% YoY from 4.87% YoY in October, on account of higher food inflation. Food inflation rose to 8.0% YoY in Nov’23, from 6.3% YoY in the previous month. Within…

In the December 2023 meeting, the RBI Monetary Policy Committee (MPC) decided to hold the repo rate at 6.5% and retained the policy stance. The RBI Governor noted that monetary policy remains ‘actively disinflationary’ to ensure anchoring of inflation expectations…