Panorama November 2025 edition is out now! Panorama is a meticulously crafted report that provides a comprehensive overview of the macroeconomic factors and market trends influencing India’s economic landscape. Here are the key insights from the report: Increase in economic…

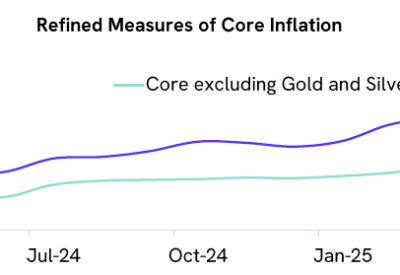

India’s Consumer Price Index (CPI) inflation eased to a series low of 0.25% YoY in October 2025, down from 1.44% in September. The impact of GST rate cuts on inflation was visible across categories. Food inflation decreased to -3.7% YoY…

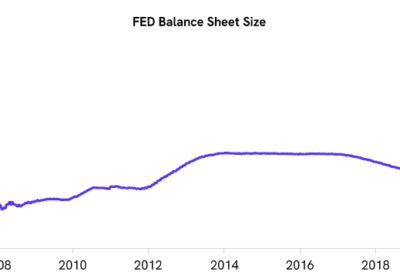

The US Federal Open Market Committee (FOMC) lowered the federal funds rate by 25 bps to 3.75–4.00% at its October 2025 meeting. The Committee also decided to conclude its quantitative tightening (QT) program. US economic activity remains resilient, and the…

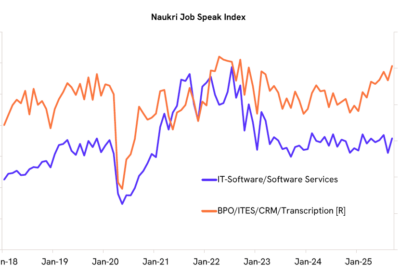

Panorama October 2025 edition is out now! Panorama is a meticulously crafted report that provides a comprehensive overview of the macroeconomic factors and market trends influencing India’s economic landscape. Here are the key insights from the report: Artificial Intelligence (AI)-driven…

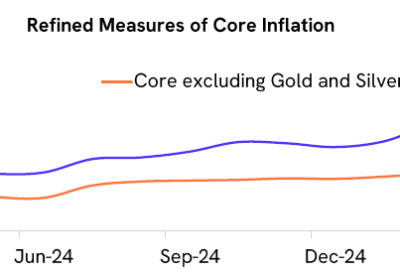

India’s Consumer Price Index (CPI) inflation eased to 1.54% YoY in September 2025 from 2.07% in August. The decline in inflation was driven by deflation in food prices. Food inflation decreased to -1.37% YoY in September 2025 from 0.05% YoY…

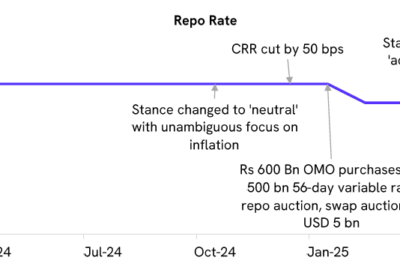

The RBI’s Monetary Policy Committee (MPC) votes to keep the repo rate steady at 5.5% and the policy stance unchanged at ‘neutral’ in the October 2025 meeting. However, MPC signals further room for monetary policy easing as the inflation outlook…

Panorama September 2025 edition is out now! Panorama is a meticulously crafted report that provides a comprehensive overview of the macroeconomic factors and market trends influencing India’s economic landscape. Here are the key insights from the report: Private corporate capital…

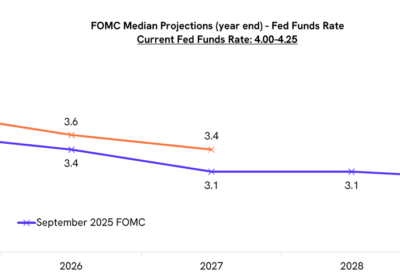

The US Federal Open Market Committee (FOMC) lowered the federal funds rate by 25 bps to 4.00–4.25% at its September 2025 meeting. The Committee also raised growth forecasts despite disappointing economic data, increasing the median projection for Q4 2025 to…

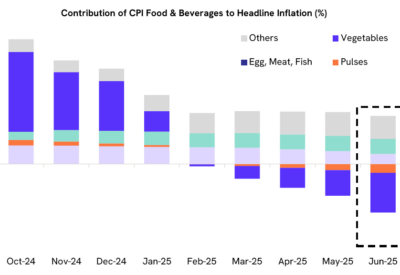

India’s Consumer Price Index (CPI) inflation rose to 2.07% YoY in August 2025, up from 1.61% in July, as food prices moved out of deflation. Food inflation increased to 0.05% YoY in August 2025 from -0.84% YoY in July. Within…

India Q1FY26 Gross Domestic Product (GDP) growth accelerated to 7.8% YoY from 7.4% YoY in the previous quarter, significantly exceeding the RBI’s projection of 6.5% YoY. Gross Value Added (GVA) picked up to 7.6% YoY in Q1 from 6.8% in…