Panorama – August 2025

Panorama August 2025 edition is out now!

Panorama is a meticulously crafted report that provides a comprehensive overview of the macroeconomic factors and market trends influencing India’s economic landscape.

Here are the key insights from the report:

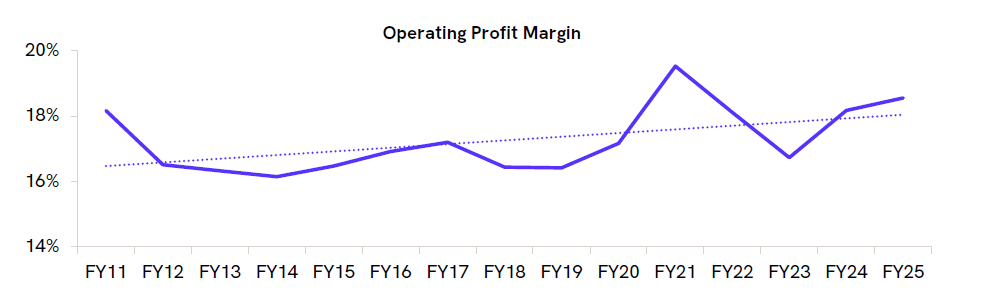

- Operating profit margins for the listed universe have generally trended upward over the past 15 years. The manufacturing sector has led to this expansion, while margins in the construction sector have declined. Among industries, telecom has witnessed the sharpest margin gains, followed by logistics, hospitality, power, and retail.

- A negative relationship exists between initial margins and subsequent changes during the period FY11–FY25. High starting margins have typically contracted over the years, as elevated profitability tends to attract new entrants and intensify competition.

- The sustained decline in headline inflation has been primarily driven by easing food prices. Core inflation, however, remains relatively firm at 4.2% in July 2025, supported by higher gold prices. Excluding gold and silver, core inflation moderates to 3.15% YoY, suggesting that underlying inflationary pressures remain contained.

- Upside risks to inflation appear limited, while downside risks to growth are more pronounced. This creates room for an additional 25-50 bps of rate cuts in the ongoing easing cycle.

- Stronger growth in corporate bonds and commercial paper has partly offset weak bank credit growth. Market borrowing has increased, as high-rated corporates and NBFCs are able to raise funds at significantly lower costs compared to traditional bank lending.