Panorama – December 2025

Panorama December 2025 edition is out now!

Panorama is a meticulously crafted report that provides a comprehensive overview of the macroeconomic factors and market trends influencing India’s economic landscape.

Here are the key insights from the report:

- We believe the RBI is nearing the end of its rate-cut cycle, with a final 25 bps cut likely in the current easing cycle if growth–inflation dynamics permit. There may be upside risks to the inflation trajectory (such as higher oil prices or adverse weather conditions) that could limit the RBI’s ability to pursue further easing.

- The RBI is expected to maintain banking system liquidity in a sufficiently large surplus (likely above 1% of NDTL) to support credit growth. The RBI may announce additional OMO purchase auctions or FX swaps if the liquidity conditions tighten.

- Long-term yields are expected to remain elevated, as another 25-bps rate cut late in the easing cycle will have a limited impact on yields as spreads widen. In addition, gross g-sec supply will likely remain heavy with limited fiscal consolidation and large redemptions.

- Central Government’s capex has witnessed a strong growth of 32% YoY in FYTD October 2025. However, budgeted FY26 capex growth of 7% YoY implies a slowdown for the rest of the fiscal year. In addition, higher social and welfare spending is likely to cap states’ capex growth.

- Capital expenditure by listed firms, a proxy for private-sector capex, has decelerated to single-digit growth after multiple years of double-digit increases. However, a sharp rise in bank-sanctioned projects indicates that the investment pipeline remains strong.

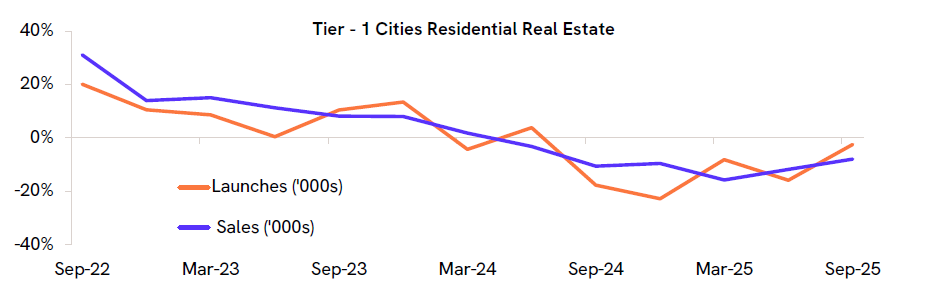

- A year-long contraction in residential sales suggests persistent weakness in household capital expenditure. Weak employment conditions, such as low wage growth, poor hiring activity, and a shift toward contractual employment, are likely to remain a drag on household investment.