Panorama – January 2026

Panorama January 2026 edition is out now!

Panorama is a meticulously crafted report that provides a comprehensive overview of the macroeconomic factors and market trends influencing India’s economic landscape.

Here are the key insights from the report:

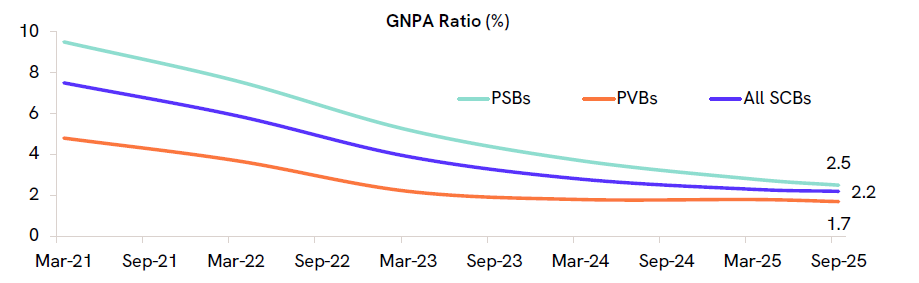

- Banking sector asset quality continues to improve, with the GNPA ratio easing to 2.2% in Sep’25 from 2.3% in Mar’25. RBI stress tests project the GNPA ratio at 1.9% by March 2027 under the baseline scenario, lower than the earlier estimate of 2.5%.

- MSME asset quality has improved steadily, with the GNPA ratio declining from 5.2% in Sep’23 to 3.3% in Sep’25. Tariff-exposed MSME sectors remain resilient, with stable asset quality metrics.

- Microfinance credit has contracted amid asset quality concerns, though stressed asset ratios have declined for three consecutive quarters. Unsecured credit remains a concern, particularly for small-ticket fintech-originated loans.

- Mid-cap earnings growth has improved steadily over the past year, reflected in marginal earnings upgrades for FY26. In contrast, small-cap earnings growth has moderated in H1FY26, leading to sharper earnings downgrades.

- Nifty earnings estimates have typically been revised downward as the end of each fiscal year approaches, though FY22 and FY24 saw limited cuts and FY23 witnessed upgrades. The FY26E and FY27E earnings trajectory is now normalising after the unusually strong resilience seen during FY22 to FY24.

- Domestic Institutional Investors (DIIs) have supported the markets even as Foreign Institutional Investors (FIIs) have been net sellers. Market supply has also been heavy, largely driven by a surge in initial public offerings.