Panorama – July 2025

Panorama July 2025 edition is out now!

Here are the key insights from the report:

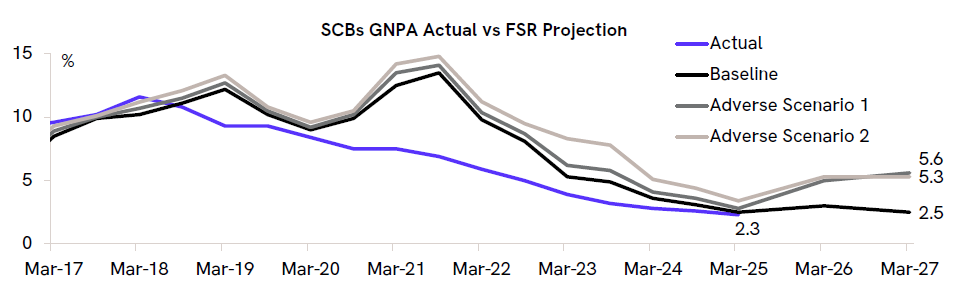

- The banking sector’s asset quality continues to improve, with the GNPA ratio at a multi-decade low. RBI’s stress tests project the GNPA ratio to rise marginally to 2.5% by March 2027, from 2.3% in March 2025 under the baseline scenario.

- Public sector banks continue to face elevated stress in credit card loans, while private sector banks have witnessed a notable deterioration in asset quality in the unsecured retail segment. Stressed assets in microfinance have risen significantly, although borrower quality has improved. However, borrower quality in small-ticket loans remains a concern, despite an improvement in the overall consumer segment risk profiles.

- Healthy bank balance sheets are likely to support a recovery in credit demand. We expect a revival in bank lending to NBFCs in FY26, following the RBI’s reduction in risk weights on banks’ exposure to NBFCs. Retail credit is also expected to recover, driven by affordable housing, personal loans, LAP, and vehicle loans.

- India received heavy pre-monsoon rainfall in the second half of May 2025. The monsoon season has progressed at a healthy pace overall, barring a brief slowdown in early June. However, spatial distribution has been uneven, with the East & North-East experiencing deficient rainfall.

- Kharif sowing is progressing well, exceeding last year’s levels across most crops. Meanwhile, reservoir storage across India is above both last year’s levels and the normal storage for this period.

- We expect CPI inflation to remain below the RBI’s June 2025 projections, potentially creating room for further rate cuts if growth risks intensify. We also expect the agriculture sector to post healthy growth, which would, in turn, support the broader rural economy.