Panorama – June 2025

Panorama June 2025 edition is out now!

Here are the key insights from the report:

- Listed corporations reported a marginal recovery in sales growth and a modest improvement in operating profit margins in FY25. Large-caps reported flat margins and muted profit growth, while small- and mid-caps witnessed healthy growth. However, earnings downgrades persisted for the third consecutive quarter, with the magnitude increasing further down the capitalisation scale.

- Banks’ margins contracted in FY25 on account of falling CASA ratio, tighter liquidity conditions, and the RBI’s clampdown on high-yielding unsecured loans. The 50-bps reduction in the repo rate in June 2025 will lead to further margin compression in the near term. However, surplus liquidity conditions in FY26, resulting from the decrease in the cash reserve ratio, open market purchases of government securities, and FX swaps, should mitigate the impact.

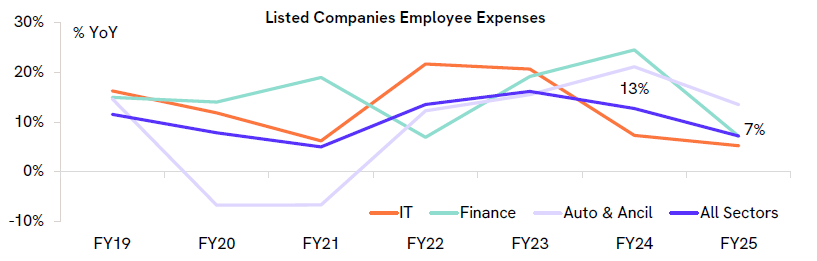

- Employee expense growth moderated further in FY25, reflecting persistent weakness in IT sector hiring and a sharp slowdown in employee cost growth in the finance sector. Muted employee expense growth is weighing on urban consumption.

- Corporate debt sustainability continued to improve in FY25. The debt-to-equity ratio improved to 0.61 in FY25 from 0.64 in FY24, while the interest coverage ratio remained steady. The proportion of debt held by highly leveraged companies, with the debt-to-equity ratio above 2, declined to 7% in FY25 from 9% in FY24.

- Corporate investments saw muted growth in FY25, possibly impacted by the general elections in Q1. However, the power sector witnessed a significant pickup in investments during the year. Meanwhile, fixed asset turnover and capacity utilisation remained above the long-term average, favouring continued capital spending.

- The macro environment — characterised by high valuations, multiple growth risks, muted growth in budgeted capex by the central government, and strained state government finances — favours defensive sectors over cyclicals in the near term. Consumption growth is also expected to marginally outpace investment growth over the next two years.