Panorama – May 2025

Panorama May 2025 edition is out now!

Panorama is a meticulously crafted report that provides a comprehensive overview of the macroeconomic factors and market trends influencing India’s economic landscape.

Here are the key insights from the report:

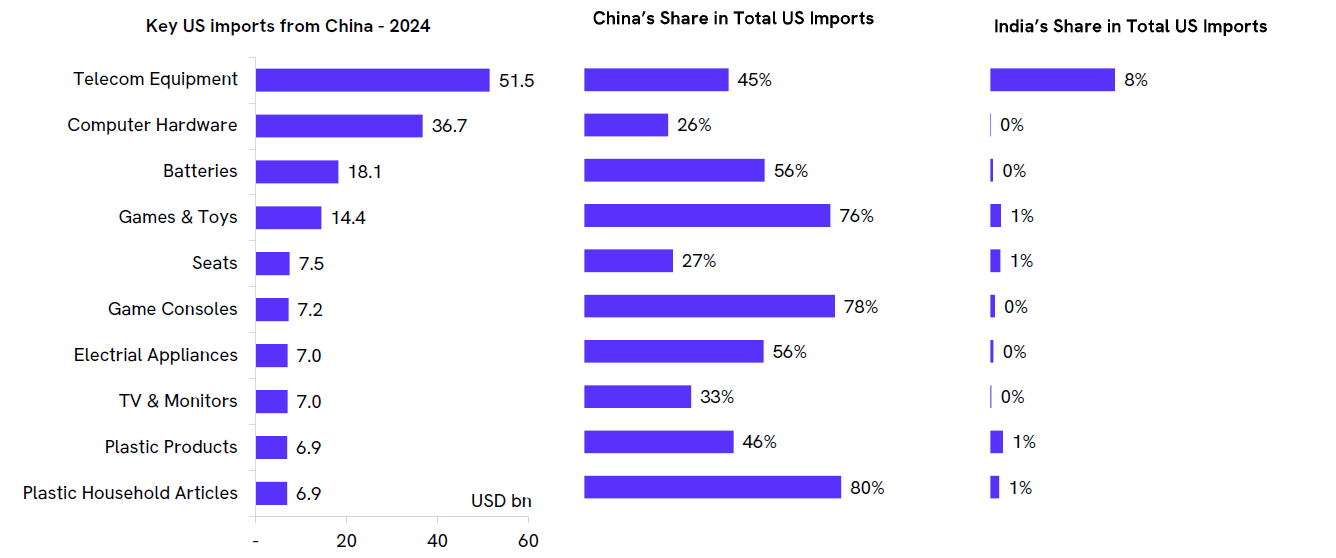

- The US and China are undergoing economic decoupling, with China’s share in US imports declining by 8 percentage points since 2016. Irrespective of the trade deal, US–China decoupling will gather pace as the two economies clash over economic, technological, and geopolitical dominance. Consequently, this presents an opportunity for India to boost manufacturing by increasing its exports to the US.

- India has achieved limited success in penetrating the US market, securing only a one percentage point increase in the share of US imports since 2016. Meanwhile, China continues to hold a dominant share of US imports across various product categories, where India’s presence remains negligible, indicating significant potential for growth.

- China will likely diversify its export markets to offset the decline in US demand. However, the surplus capacity in several Chinese industries and weak domestic demand raise the risk of dumping in other countries at artificially low prices. Hence, India risks remaining confined to low-value manufacturing, dependent on cheaper Chinese inputs, with only the final assembly carried out domestically.

- India’s Mcap/GDP has expanded faster than the recovery in PAT/GDP. The expansion has primarily been driven by a swifter increase in Mcap/GDP for mid- and small-caps compared to large caps, signalling that valuations in the mid- and small-cap segments are significantly stretched.

- The relative P/B ratio to large caps also suggests stretched valuations in small- and mid-caps, with earnings yields supporting this view. Hence, large caps offer a better risk-reward ratio than small- and mid-caps.