Panorama – September 2025

Panorama September 2025 edition is out now!

Panorama is a meticulously crafted report that provides a comprehensive overview of the macroeconomic factors and market trends influencing India’s economic landscape.

Here are the key insights from the report:

- Private corporate capital expenditure has rebounded strongly since bottoming out in FY21. The recovery, however, is not fully reflected in bank credit growth as corporates increasingly rely on non-bank sources for funding. In inflation-adjusted terms, private capex in FY2024–25 remains below FY2011–12 levels, and the significantly higher number of planned projects implies much smaller project sizes.

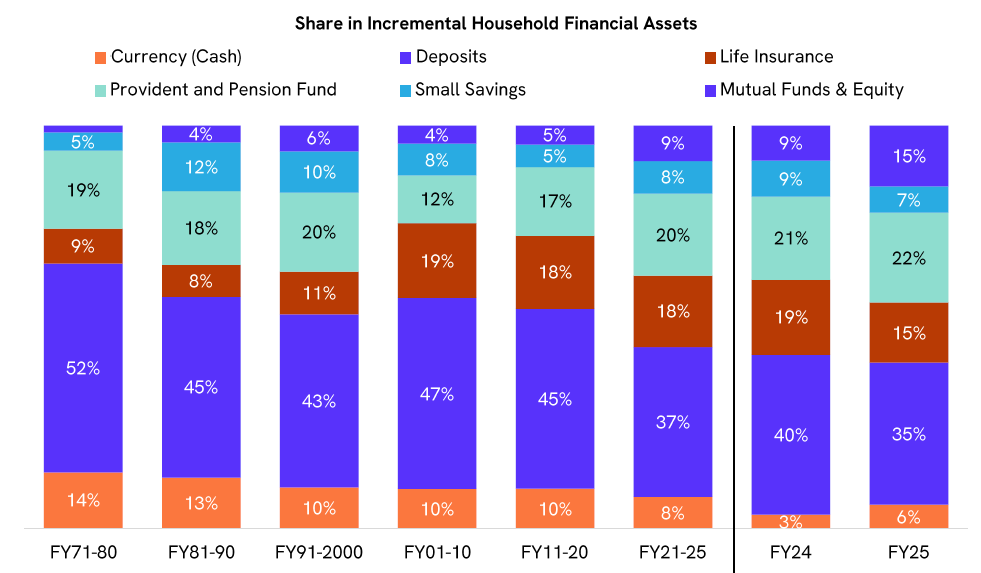

- Net financial savings (incremental financial assets minus liabilities) of Indian households improved for the second consecutive year, rising to 6.0% of GDP in FY25 from the trough of 4.9% in FY23. A moderation in incremental household liabilities primarily drove the improvement. Household participation in mutual funds and equities rose sharply in FY25, while the share of deposits in savings declined.

- Indian household (HH) debt-to-GDP has risen consistently since 2017, reaching 42% in March 2025. However, it remains below the emerging market (EM) average of 47%. Within bank lending, consumption-oriented loans have grown faster than those for productive purposes or asset creation, but they still account for only 19% of total household credit.

- GST 2.0 could provide a ~Rs 2 tn boost to consumption & push GDP growth higher by 40-50 bps. It can also reduce inflation by one percentage point with complete pass-through of tax cuts. However, monetary policy may look through GST 2.0’s one-off, transitory impact on inflation.

- The monsoon will likely end above normal, though regional disparities persist. Northwest India faces a heavy surplus, while East and Northeast India witness rainfall deficiencies. Intense rains have caused flooding across parts of Northwest India, likely impacting crop yields and agricultural production. However, reservoir storage levels remain comfortable across regions, which bodes well for the upcoming rabi season.