Trends & Tides – Balance of Payments Q4FY25

India’s current account registered a surplus of 1.3% of GDP in Q4FY25, compared to a deficit of 1.1% in the previous quarter and a surplus of 0.5% in Q4FY24. The improvement was driven by a seasonal reduction in the merchandise trade deficit during Q4.

There was a broad-based decline in the merchandise trade deficit in Q4FY25, spanning petroleum products, valuables, and core merchandise. Meanwhile, the services surplus increased due to an improvement in business services.

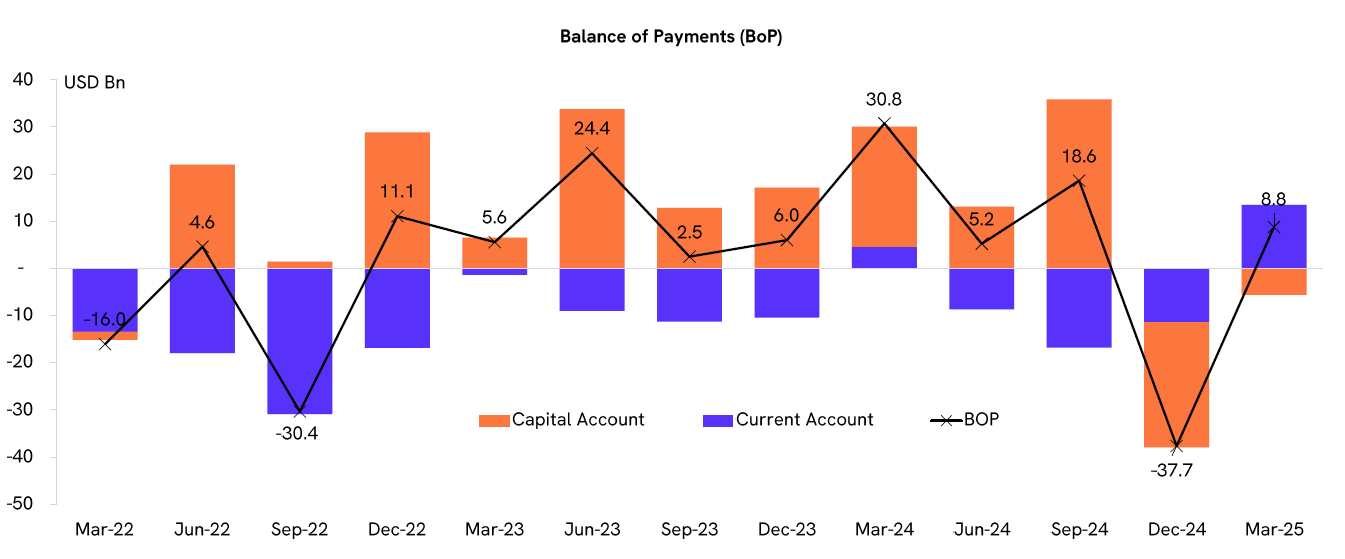

The capital account recorded a deficit of US$5.6 billion in Q4FY25, significantly lower than the US$26.6 billion deficit in Q3FY25. The improvement was driven by lower FPI outflows, with higher FPI debt inflows partially offsetting increased FPI equity outflows.

Overall, the Balance of Payments recorded a surplus of US$8.8 billion in Q4, reversing the US$37.7 billion deficit seen in the previous quarter. However, India’s forex reserves increased by US$32.6 billion in Q4FY25, aided by a US$23.8 billion valuation gain on account of US dollar weakness.

The current account deficit is expected to be around 0.7% of GDP in FY26. However, high economic uncertainty, trade disputes, and geopolitical flare-ups pose significant risks to the outlook.