Trends & Tides – India CPI December 2025

India’s retail inflation rose to 1.33% YoY in December 2025 from 0.71% YoY in the previous month. The uptick was primarily driven by a lower disinflationary impact from food prices.

Food inflation increased to -1.8% YoY in December 2025 from -2.8% YoY in November. Within the food basket, vegetable inflation increased to -18.5% YoY from -22.2% YoY a month earlier. The smaller seasonal decline in vegetable prices of 2.9% MoM in December, compared with a 7.4% MoM fall last year, was a key driver of the rise in headline CPI inflation.

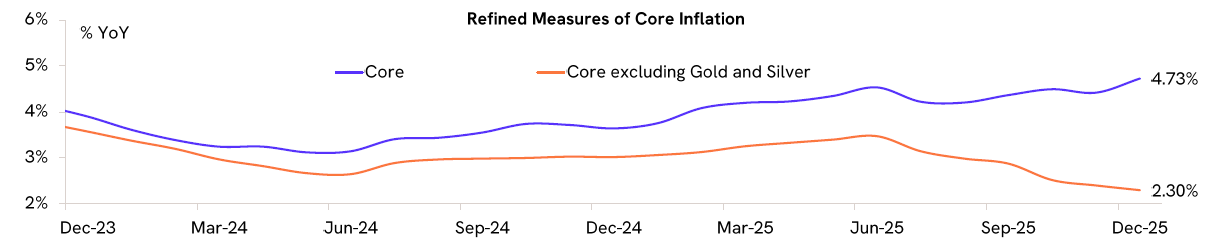

Core inflation (which excludes food and fuel) picked up to 4.7% YoY in December 2025. Excluding gold and silver, core inflation was 2.3% YoY, indicating that underlying inflationary pressures remain low.

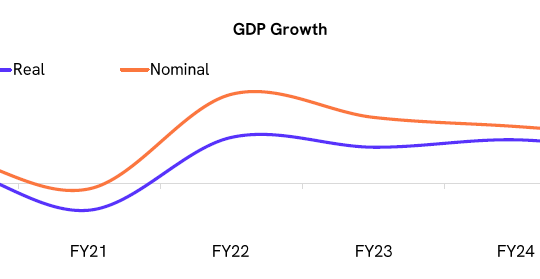

We expect inflation to remain anchored around 4% target in FY27. However, weak growth in kharif production and a sustained rise in precious metal prices pose upside risks to inflation.

We believe the rate-cut cycle is nearing its end. While supportive growth and inflation dynamics could allow for one final 25 bps cut, that would likely conclude the cycle.