Trends & Tides – India CPI October 2025

India’s Consumer Price Index (CPI) inflation eased to a series low of 0.25% YoY in October 2025, down from 1.44% in September. The impact of GST rate cuts on inflation was visible across categories.

Food inflation decreased to -3.7% YoY in October 2025 from -1.4% YoY in September. Within the food basket, vegetable inflation declined sharply to -27.6% YoY from -21.4% YoY a month earlier. The drop in vegetable prices was the key driver behind the moderation in headline CPI inflation. Other food categories, such as edible oil and cereals, also contributed.

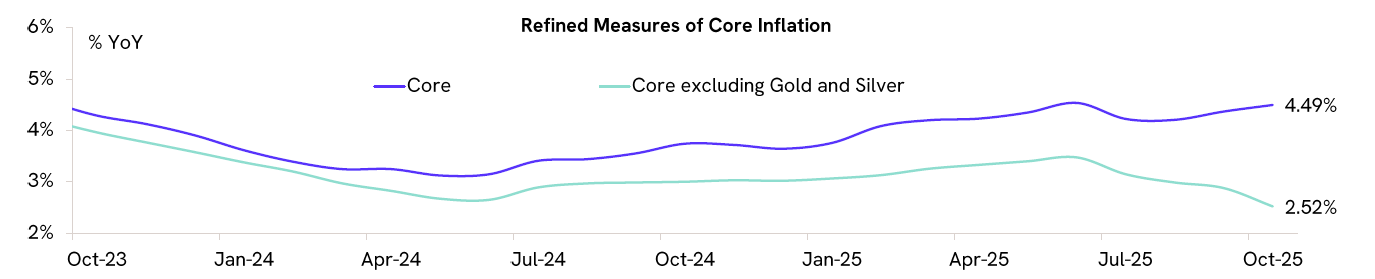

Core inflation (excluding food and fuel) picked up to 4.5% YoY from 4.4% in the previous month, primarily due to a rise in gold & silver prices. Excluding gold and silver, core inflation was 2.5% YoY, indicating that underlying inflationary pressures remain low.

We expect inflation to substantially undershoot the RBI’s current projections. While October’s reading likely marks the bottom, and inflation should edge higher in the coming months, it will likely remain below 4% over the next few quarters.

The RBI opted for a dovish pause in the October 2025 meeting, indicating that policy space has opened up to support growth further. Accordingly, we expect additional monetary easing, with a 25-bps rate cut likely in the next policy meeting.