Trends & Tides – India CPI September 2025

India’s Consumer Price Index (CPI) inflation eased to 1.54% YoY in September 2025 from 2.07% in August. The decline in inflation was driven by deflation in food prices.

Food inflation decreased to -1.37% YoY in September 2025 from 0.05% YoY in August. Within the food basket, vegetable inflation declined sharply to -21.4% YoY from -15.9% YoY a month earlier. The drop in vegetable prices was the key driver behind the moderation in headline CPI inflation.

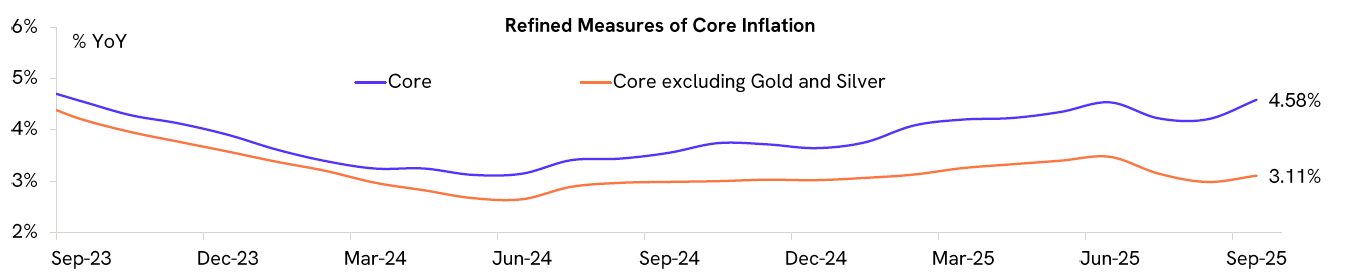

Core inflation (excluding food and fuel) picked up to 4.6% YoY, primarily due to a rise in gold & silver prices. Excluding gold and silver, core inflation was more moderate at 3.1% YoY, indicating that underlying inflationary pressures remain muted.

We expect inflation to undershoot the RBI’s latest projection of 2.6% YoY for FY26. A steady rise in gold prices may keep the core inflation elevated, but the recent GST reduction could offer some relief.

The RBI opted for a dovish pause in the October 2025 meeting, indicating that policy space has opened up to support growth further. Accordingly, we expect additional monetary easing, with a 25-bps rate cut likely in the next policy meeting.