Trends & Tides – India GDP Q4FY25 and FY25

India’s real GDP growth accelerated to 7.4% YoY in Q4FY25 from 6.4% in the previous quarter.

In Q4FY25, the agriculture sector recorded healthy growth of 5.4%, supported by strong agricultural output. The manufacturing sector’s growth further recovered to 4.8% YoY from 3.6% YoY in the previous quarter, as improved operating profit growth of listed manufacturers offset the weaker Index of Industrial Production (IIP) manufacturing growth. Services sector growth remained resilient as weakness in the Trade+ segment was more than offset by strong construction activity and improvement in the Financial Services+ segment.

Private consumption growth slowed to 6.0% YoY in Q4FY25 from 8.1% in the previous quarter, as indicators point to subdued urban consumption. Fixed investment growth rebounded to 9.4% YoY in Q4 from 5.2% in Q3 as government capital expenditure picked up. Exports recorded decent growth of 3.9% YoY in real terms in Q4, while imports contracted by 12.7% YoY.

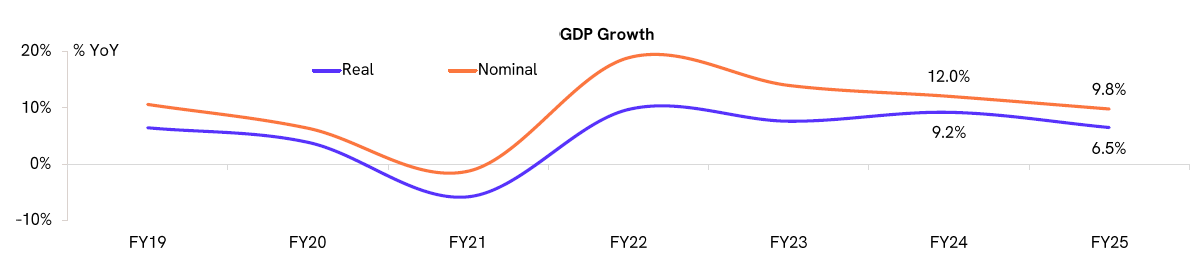

For FY25, real GDP growth eased to 6.5% YoY from 9.2% in the previous year. Nominal GDP growth declined to 9.8% YoY in FY25 from 12% YoY in FY24, as weaker real GDP growth outweighed the impact of a higher GDP deflator (inflation). On the production side, the manufacturing sector witnessed the steepest decline in its contribution to GDP growth in FY25, while on the expenditure side, fixed investment experienced the sharpest drop in contribution, followed by government consumption.

We expect FY26 GDP growth to be around 6.5-6.7% YoY. Lower interest rates, easing inflation, and income tax reductions are fostering a supportive environment for economic growth. However, heightened geopolitical tensions, rising geo-economic fragmentation, and elevated economic uncertainty pose downside risks.