Trends & Tides – RBI Monetary Policy December 2025

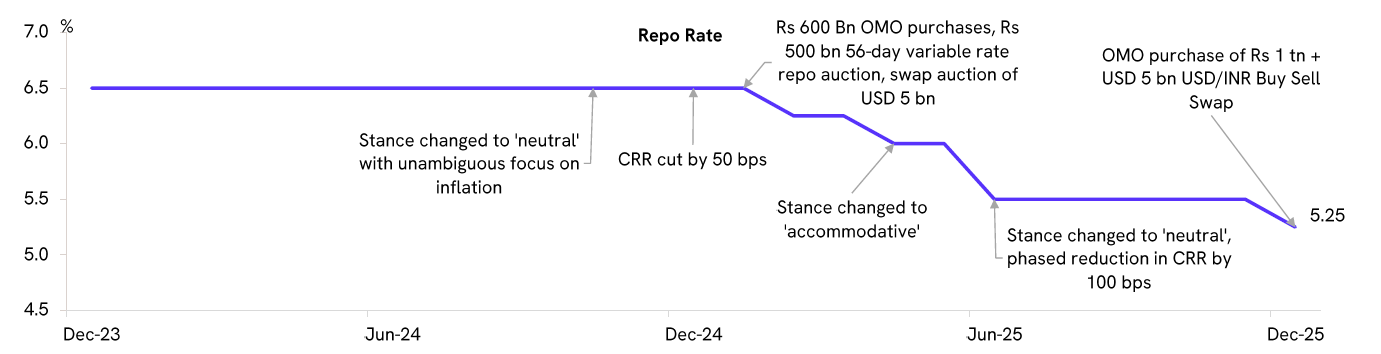

The RBI’s Monetary Policy Committee (MPC) votes unanimously to reduce the policy repo rate by 25 bps to 5.25% in the December 2025 meeting. The policy stance remains unchanged at ‘neutral’. The RBI also announces liquidity infusion of Rs 1.45 tn in December 2025 to facilitate monetary transmission.

The MPC statement notes that headline inflation has eased significantly and is likely to be softer than earlier projections, primarily due to exceptionally benign food prices. It also highlights that underlying inflation pressures are even lower than suggested by the headline and core inflation prints, as these have been lifted by rising precious metal prices.

The RBI has revised the FY26 CPI inflation forecast to 2.0%, down from 2.6% in the previous policy. Expectations of higher kharif output, healthy rabi sowing, adequate reservoir levels, and favourable soil moisture conditions support the downward revision. RBI also expects international commodity prices, barring some metals, to moderate going forward.

The RBI has revised the FY26 GDP growth projection to 7.3% YoY, up from 6.8% in the previous policy. Healthy agricultural prospects, GST rationalisation, benign inflation, and strong services exports are expected to support growth, while risks stem from potential headwinds to merchandise exports and broader external uncertainties.

We believe the rate-cut cycle is now nearing its end. If the growth and inflation dynamics remain supportive, there may still be room for one more 25 bps cut, but that would likely mark the end of this cycle. We also expect the RBI to maintain a comfortable liquidity surplus to ensure swift transmission to the deposit and credit markets, and to deploy further OMO purchase auctions or FX swaps if required.