Trends & Tides – RBI Monetary Policy February 2026

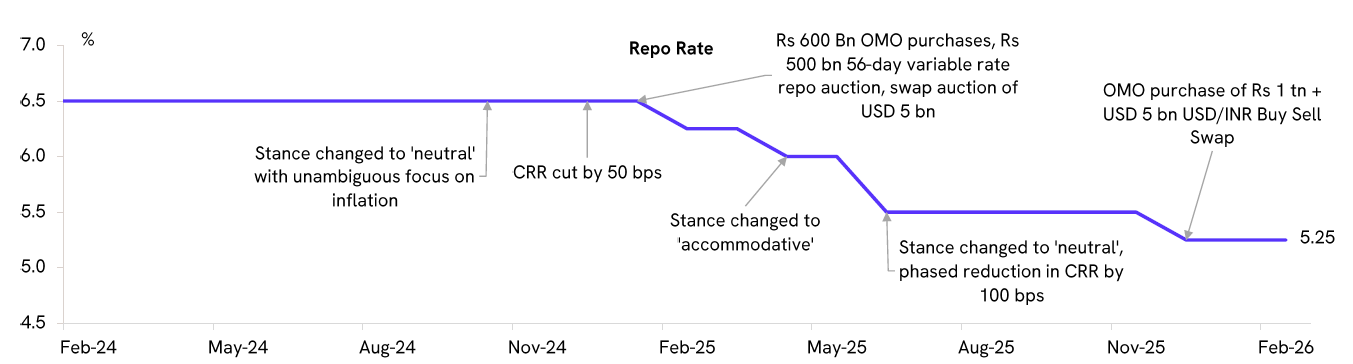

The RBI’s Monetary Policy Committee (MPC) kept the repo rate and policy stance unchanged in its February 2026 meeting, citing a stable growth and inflation outlook. The MPC statement noted that underlying inflation remains low and the growth outlook is favourable. However, the RBI refrained from providing economic projections for H2FY27, opting to await the revised CPI and GDP series.

The RBI revised its FY26 CPI inflation forecast to 2.1%, up from 2.0% in the previous policy. Projections for H1FY27 were also revised upward by 10–20 bps, primarily due to higher precious metal prices. The overall favourable inflation outlook is supported by healthy kharif production, adequate buffer stocks of foodgrains, and favourable rabi sowing. Nevertheless, geopolitical uncertainty, volatility in energy prices, and adverse weather events pose upside risks.

On growth, the RBI revised H1FY27 GDP projections marginally upward by 20 bps, reflecting resilient economic activity. The policy statement highlighted that the landmark comprehensive trade pact with the European Union, along with other trade agreements, should help diversify exports and strengthen the external sector. Merchandise exports are also expected to benefit from a prospective trade deal with the US. However, geopolitical tensions, global trade uncertainty, financial market volatility, and commodity price swings continue to pose downside risks.

While the growth outlook remains largely stable, inflation risks have emerged amid rising commodity prices. Nonetheless, there is scope for at most one additional rate cut, provided the inflation trajectory remains benign. Going forward, policy focus is likely to shift toward more effective liquidity management.