Trends & Tides – RBI Monetary Policy October 2025

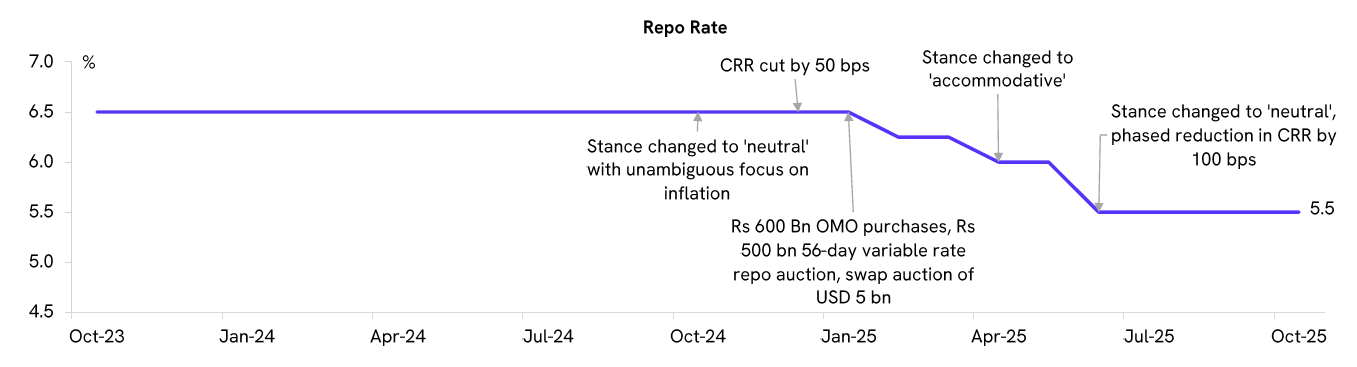

The RBI’s Monetary Policy Committee (MPC) votes to keep the repo rate steady at 5.5% and the policy stance unchanged at ‘neutral’ in the October 2025 meeting. However, MPC signals further room for monetary policy easing as the inflation outlook has turned benign, while growth continues to fall short of aspirations.

The MPC statement notes that macroeconomic conditions have created policy space to further support growth. Prevailing global uncertainties and tariff-related developments are likely to slow growth in H2FY26 and beyond. However, front-loaded monetary policy actions and recent fiscal measures are still playing out; hence, the MPC opted to pause in the current policy.

The RBI has lowered its FY26 CPI inflation projection to 2.6% from 3.1% in the previous policy. The downward revision reflects benign food prices and GST rate cuts. Healthy progress of the south-west monsoon, higher kharif sowing, adequate reservoir levels and a comfortable buffer stock of foodgrains also bode well for food inflation. Core inflation for FY26 and Q1FY27 is also expected to remain contained.

The RBI has revised its FY26 GDP growth projection upward to 6.8% YoY from 6.5% in the previous policy. Growth is expected to receive a boost from the rationalisation of GST rates. However, ongoing tariff and trade policy uncertainties will likely weigh on external demand for goods and services.

Overall, the RBI has opted for a dovish pause in the October meeting. We expect additional monetary easing in the current cycle, with a 25-bps rate cut likely in the next policy meeting.