Trends & Tides – US FOMC September 2025

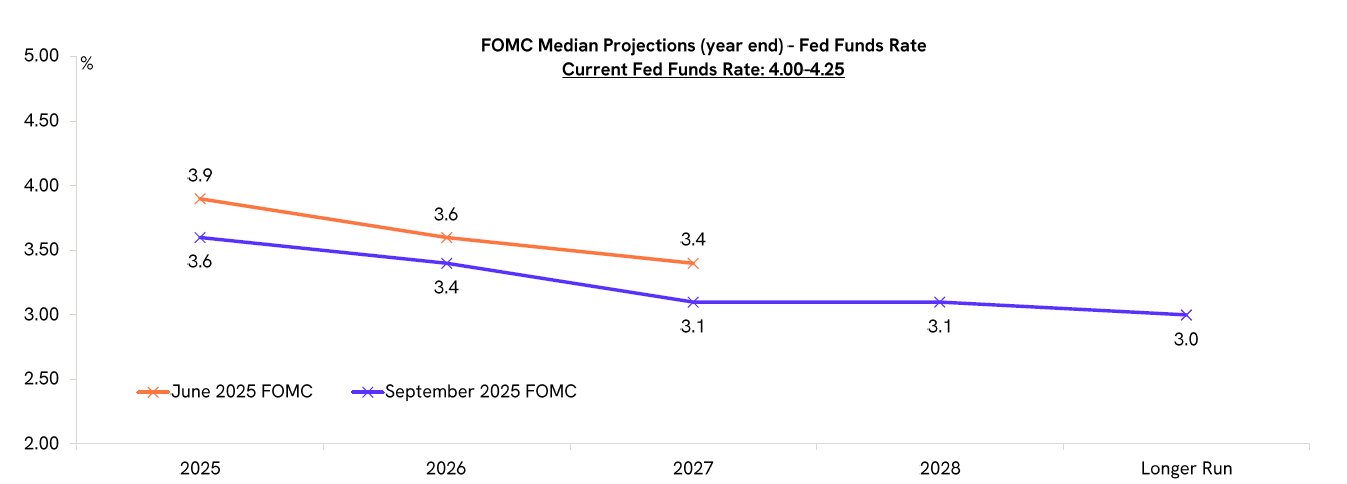

The US Federal Open Market Committee (FOMC) lowered the federal funds rate by 25 bps to 4.00–4.25% at its September 2025 meeting.

The Committee also raised growth forecasts despite disappointing economic data, increasing the median projection for Q4 2025 to 1.6% in September policy from 1.4% in June. While US economic uncertainty has eased from its peak, it still remains elevated.

The inflation projection for Q4 2025 was left unchanged, while that for Q4 2026 was revised higher. The core PCE inflation forecast for Q4 2026 was raised to 2.6% from 2.4% in the June policy. The FOMC statement noted that inflation has moved up and remains somewhat elevated. Higher import tariffs have begun to appear in inflation prints. However, Chair Jerome Powell reiterated that tariff impacts are likely to cause only a one-time price jump, with inflation unlikely to persist amid a weaker labour market.

The unemployment rate projection for 2025 was left unchanged, while forecasts for 2026 and 2027 were revised lower. The statement highlighted that job gains have slowed and the unemployment rate has edged up, though it remains low.

The Committee stressed that it remains attentive to risks on both sides of its dual mandate and judges that downside risks to employment have increased. The dot plot indicates an additional 50 bps of rate cuts in 2025, followed by 25 bps in 2026. However, Powell struck a cautious tone in the post-policy press conference, framing the September rate cut as ‘risk management’ in response to labour market softness, while emphasising that there is no urgency to accelerate easing.