Trends & Tides – US FOMC July 2025

The US Federal Open Market Committee (FOMC) kept the federal funds rate unchanged at 4.25%-4.50% in its July 2025 meeting. In the post-policy press conference, Federal Reserve Chair Jerome Powell mentioned that while policy rates remain ‘moderately restrictive,’ the economy is not showing signs of being unduly constrained, and a modestly restrictive stance continues to be appropriate.

US economic activity has lost momentum amid uncertainty surrounding import tariffs and erratic policymaking. Recent data releases have also fallen short of market expectations. The FOMC statement also noted that economic activity moderated in the first half of the year. However, GDP growth forecasts for 2025 appear to have bottomed out as uncertainty has eased from earlier peaks, with trade deals now being finalised.

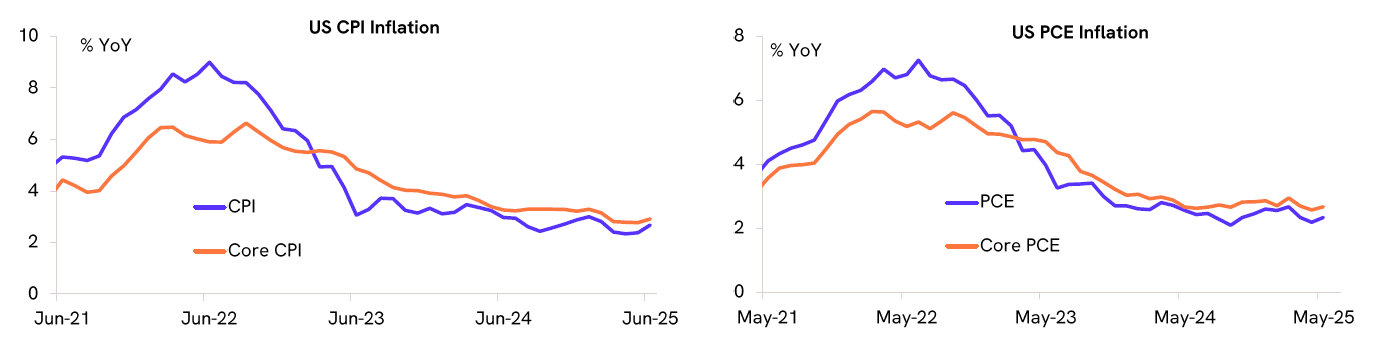

Recent inflation prints have been broadly encouraging, coming in below market expectations. The impact of higher import tariffs has not yet shown up in the data. However, the FOMC statement maintained that inflation remains ‘somewhat elevated.’ Markets expect inflation to average around 2.5% over the next five years.

The US labour market remains resilient, with steady payroll gains and a low unemployment rate. The FOMC also noted that labour market conditions remain solid. However, signs of gradual easing are emerging, including a decline in job openings and a moderation in earnings growth.

The FOMC highlighted elevated uncertainty around the economic outlook. Meanwhile, treasury yields remain elevated as Powell tempered expectations of a September rate cut. Markets now expect only a 25-basis-point cut by the end of 2025.