Trends & Tides – US FOMC June 2025

The US Federal Open Market Committee (FOMC) held the federal funds rate steady at 4.25–4.50% at its June 2025 meeting.

The FOMC revised its growth projections downward. The median forecast for Q4 2025 was lowered to 1.4% in the June 2025 projections, down from 1.7% in March. Recent weakness in US economic data, coupled with heightened uncertainty, triggered the downgrade.

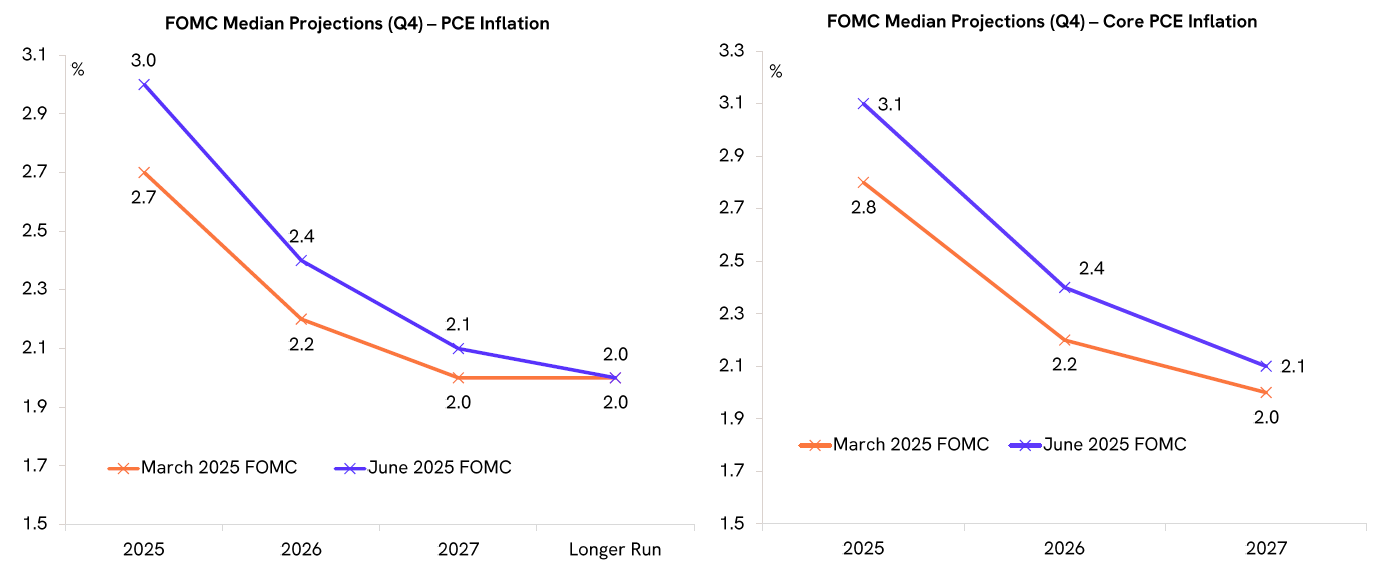

The FOMC also revised its inflation projections upward. Core PCE inflation is now projected at 3.1% for Q4 2025, up from 2.8% in the March policy update. So far, tariff increases have not been reflected in inflation prints. However, in the post-policy press conference, Fed Chair Jerome Powell noted that the cost of tariffs would ultimately need to be borne, with part of it likely falling on end consumers. The FOMC statement also noted that inflation remains “somewhat elevated.”

The FOMC raised its unemployment rate projection for 2025 to 4.5%, up from 4.4% earlier. However, the statement maintained that the unemployment rate has stabilised at a low level, and labour market conditions remain solid.

The FOMC dot plot indicates 50 bps of rate cuts in 2025, followed by another 25 bps in 2026. However, divisions among the 19 members underscore ongoing uncertainty — seven members expect no cuts, while two project only one rate cut in 2025. The policy statement noted that uncertainty around the economic outlook has diminished but remains elevated. Powell stated that policymakers are “well positioned to wait” before proceeding with further rate cuts.