Trends & Tides – US FOMC October 2025

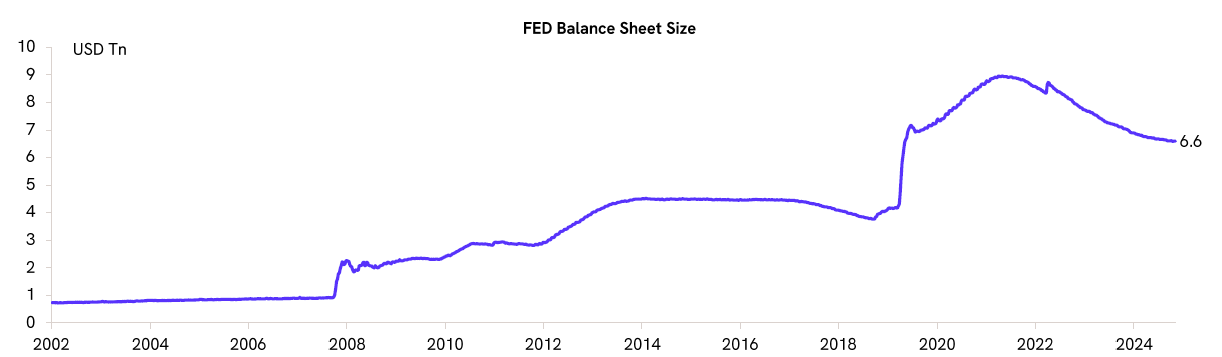

The US Federal Open Market Committee (FOMC) lowered the federal funds rate by 25 bps to 3.75–4.00% at its October 2025 meeting. The Committee also decided to conclude its quantitative tightening (QT) program.

US economic activity remains resilient, and the outlook has improved on the back of better-than-expected data releases and a decline in economic uncertainty. However, labour market conditions remain weak. The FOMC statement acknowledged that job gains have slowed this year and that the unemployment rate has edged higher. It also noted that downside risks to employment have increased in recent months.

Tariff pass-through has started to push US inflation higher. However, recent data have undershot market expectations, suggesting a smaller-than-anticipated impact so far. Chair Powell nonetheless highlighted further upside risks to inflation. The FOMC statement also observed that inflation has risen since earlier in the year and remains somewhat elevated.

In addition, the FOMC reiterated that uncertainty about the economic outlook remains high and that the Committee remains attentive to risks on both sides of its dual mandate.

During the post-policy press conference, Powell pushed back against expectations of another rate cut in December 2025. He cautioned investors that policy is not on a preset course and that a further reduction in the policy rate at the December meeting is “not a foregone conclusion.” Powell argued for a potential pause, citing the economy’s resilience, possible data gaps from the government shutdown, and the cumulative 150 bps of rate cuts already delivered.