Trends & Tides – RBI Monetary Policy August 2025

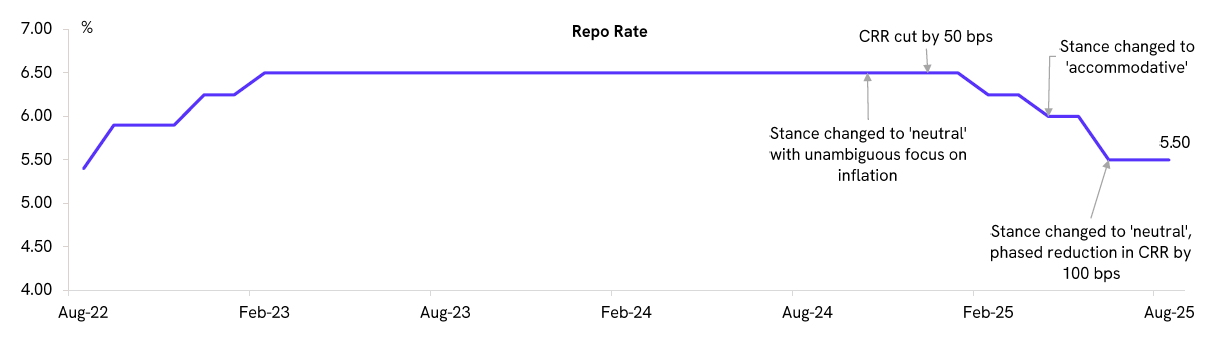

The RBI’s Monetary Policy Committee (MPC) votes to keep the repo rate steady at 5.5% and the policy stance unchanged at ‘neutral’ in the August 2025 meeting. The RBI awaits further transmission of the front-loaded rate cuts to credit markets and the broader economy.

The MPC statement notes that headline inflation is much lower than earlier projected, mainly due to volatile food prices. However, core inflation remains steady at around 4%, and overall inflation is expected to rise from the last quarter of the current financial year.

The RBI has lowered its FY26 CPI inflation projection to 3.1% from 3.7% in the previous policy. The downward revision reflects steady progress of the southwest monsoon, healthy kharif sowing, adequate reservoir levels, and comfortable buffer stocks of foodgrains. However, weather-related shocks continue to pose risks to the inflation outlook.

The RBI has retained its FY26 GDP growth projection at 6.5% YoY. The MPC statement notes that growth has held up well, with some pick-up expected in the coming festive season. Supportive monetary, regulatory and fiscal policies should boost demand. However, external demand remains uncertain amid tariffs and trade talks, while geopolitical tensions and global market volatility continue to weigh on the growth outlook.

Downside risks to growth have intensified, particularly after the US imposed higher-than-expected reciprocal tariffs. Meanwhile, inflation prints have largely surprised to the downside, prompting the RBI to revise its projections lower. With limited upside risks to inflation, we see room for at least one more 25-bps rate cut in the current easing cycle, potentially as early as October 2025.