Trends & Tides – RBI Monetary Policy June 2025

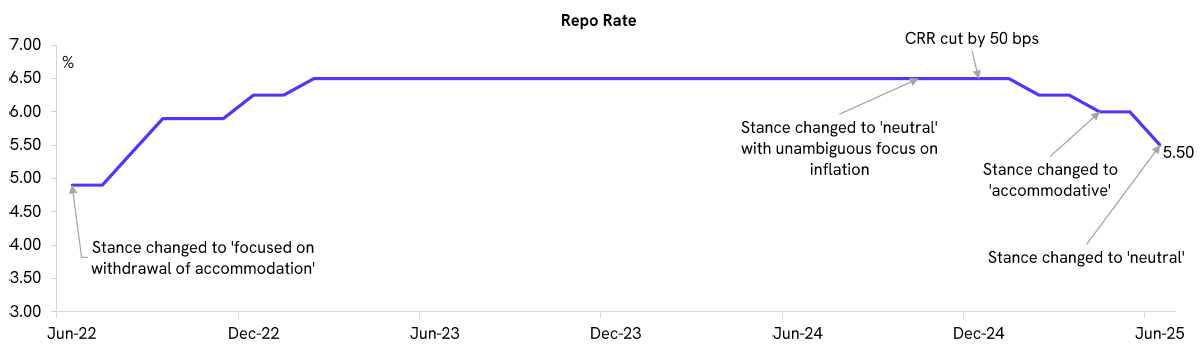

The RBI Monetary Policy Committee (MPC) voted to reduce the policy repo rate by 50 basis points, from 6.00% to 5.50%, in the June 2025 policy. The RBI announced a phased 100 basis points reduction in the Cash Reserve Ratio (CRR) to 3.0%, which will inject durable liquidity of ~Rs 2.5 trillion into the banking system by December 2025.

The MPC believes that monetary policy now has very limited room to further support growth under the current circumstances. Therefore, the MPC decided to shift the stance from ‘accommodative’ to ‘neutral’.

The RBI lowered its FY26 CPI inflation projection to 3.7% YoY from 4.0% in the previous policy. The RBI appeared confident of a durable alignment of headline inflation with the 4% target. The outlook is supported by record wheat production, encouraging kharif crop prospects, and moderation in both inflation expectations and commodity prices. However, adverse weather-related supply disruptions and evolving tariff-related uncertainties pose upside risks to the inflation trajectory.

The RBI retained its FY26 GDP growth projection at 6.5% YoY. Agricultural prospects remain bright on the back of an above-normal south-west monsoon forecast. Sustained rural economic activity bodes well for rural demand, while continued expansion in the services sector is expected to support the revival of urban demand. However, trade policy uncertainty, protracted geopolitical tensions and weather-related uncertainties pose downside risks to growth.

We expect the RBI to adopt a ‘wait and watch’ approach in the near term. We see room for another 25 bps cut in the current cycle if growth risks intensify and the inflation outlook remains favourable.